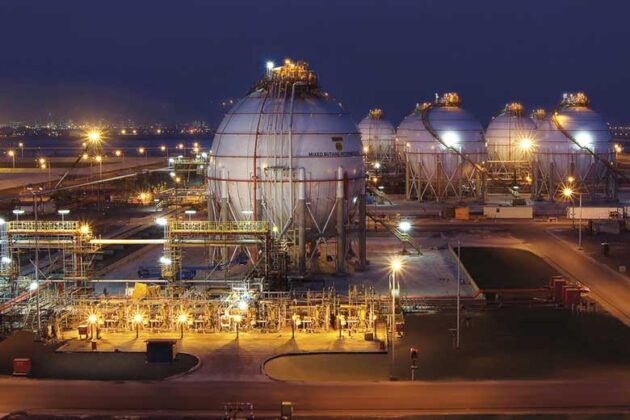

Borouge Group International Redefines the Petrochemical Frontier

Something colossal is happening in the world of chemicals! The Abu Dhabi National Oil Company (ADNOC) and Austria’s OMV have ignited a firestorm of innovation by forging Borouge Group International, a $60 billion juggernaut that’s set to dominate the global stage. This isn’t just a merger; it’s a seismic shift, a daring leap into the future of petrochemicals, where polyolefins—the versatile plastics like polyethylene and polypropylene that shape our everyday lives—take centre stage. From the packaging that holds your groceries to the pipes that carry water to your home, this deal touches everything.

Picture this: Borouge Group is now the fourth-largest polyolefin producer in the world, elbowing its way into the big leagues behind only China’s Sinopec, CNPC, and the U.S.’s ExxonMobil. ADNOC’s Khaled Salmeen couldn’t hide his excitement, and for good reason—this is a masterstroke!

The new titan is born from two existing partnerships: Borealis, where OMV holds 75% and ADNOC 25%, and Borouge, with ADNOC at 54% and Borealis at 36%. But they didn’t stop there. They’ve snapped up Canada’s Nova Chemicals from Abu Dhabi’s Mubadala fund for a cool $13.4 billion, debt included. Nova churns out 2.6 million tons of polyethylene and 4.2 million tons of ethylene yearly, planting Borouge’s flag firmly in North America.

Sultan Al Jaber, ADNOC’s fearless leader, declared this a defining moment—Abu Dhabi isn’t just playing the game; it’s rewriting the rulebook, cementing its place as a chemicals superpower. After two years of negotiations, especially over Nova, the deal is set to close in early 2026, pending regulatory approval. OMV’s Alfred Stern admitted the talks were a rollercoaster, but the result? A company that’s pure dynamite.

Headquartered in Austria, Borouge Group will see ADNOC and OMV each holding 47%, with the rest up for grabs by public investors. OMV is tossing in 1.6 billion euros ($1.68 billion) to even the scales.

The rewards are staggering: $500 million in annual savings, $2.2 billion in yearly dividends, and the $7.5 billion Borouge 4 project joining the fold. By 2026, they’ll raise $4 billion to join a top stock index, with a potential Austrian listing in 2027.ADNOC’s—snagged Germany’s Covestro for 14.7 billion euros last October. Soon, their Borouge stake will move to XRG, their new global investment arm. Investors are buzzing—OMV’s stock surged 4%—though JPMorgan warns the deal’s complexity might take time to sink in. With equal governance and a powerhouse lineup, Borouge Group is a blazing comet, lighting up the petrochemical sky!